How Do You Know if a Cashiers Check Is Fraudulent

How To Verify a Cashier's Check: 3 Precautions To Take

- How To Verify

- How To Cash

- Victims of Fraud

Unlike a personal check, a cashier's check is a direct obligation of the bank. Equally a result, there is virtually no hazard that a cashier's check will bounce or otherwise be invalid.

Unfortunately, fraudsters can create phony cashier's checks and use them for cheque scams. Acquire how to verify a cashier's bank check and so you tin avoid being a victim of check fraud.

How To Verify a Cashier's Check

Yous tin take precautions to ensure that a cashier's check is legitimate. To avert beingness a fraud victim, follow these steps on how to verify a cashier'south check.

Quick Steps To Verify

- Don't accept information technology if it's for more than the purchase price.

- Look out for a watermark, microprint or a red flag: typos.

- Visit or call the issuing depository financial institution and ask for verification.

Here's a closer await at the steps you lot should accept to avert scams involving cashier's checks.

1. Don't Have a Cashier's Check If There Are Signs of a Scam

One mutual cashier'due south check scam involves someone overpaying for an online purchase — so if you receive a cashier'southward cheque for more than the purchase price, don't accept it.

For example, a buyer based outside the U.S. sends a cashier's check seemingly from a U.S.-based bank and asks you lot to refund the overage separately. Federal law requires that funds from a deposited cashier's check exist fabricated available in ane business twenty-four hours. By the time the fraudulent cheque is discovered days or weeks later, the buyer is nowhere to be found. Considering you made the deposit, the bank can hold y'all liable for the fraud.

In addition to the overpayment scam, other common scams to watch out for include:

- Prize or lottery awards

- Prepayment for mystery shopping involving check deposits and wire transfers

If the circumstances seem too good to be true, they probably are.

ii. Examine the Cashier's Check

Cashier'south checks oftentimes include a singled-out feature specific to the bank and frequently tell you what to look for. If the bank check states there is a watermark or microprint, look for that on the check. If it'southward missing, the check might not exist valid.

Typos are some other giveaway that a check is phony, as fake cashier's checks sometimes come from senders overseas.

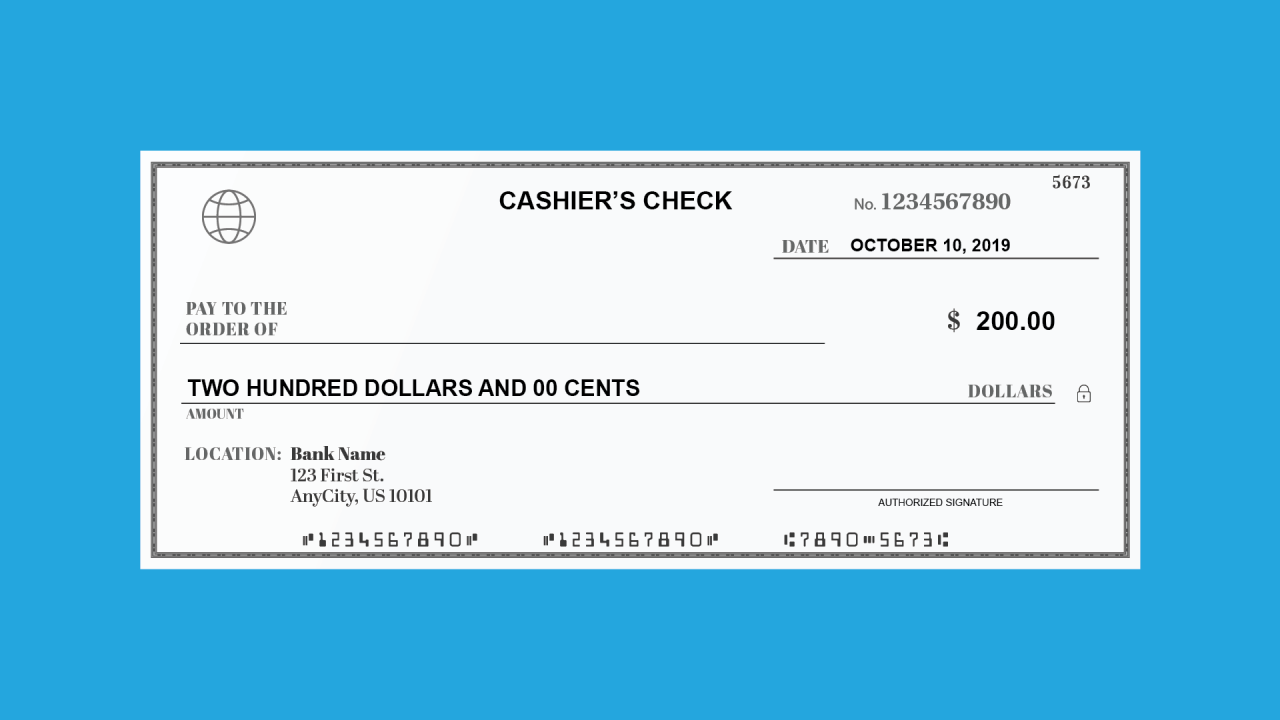

Here's how a cashier's check typically looks:

3. Visit or Telephone call the Bank

Just the depository financial institution that issued a cashier's check tin truly verify it. Keep in mind that you tin't verify a cashier's bank check online, but other options are available.

If the check is issued from a bank that has a branch nigh you, there's no meliorate approach than to take the check into the depository financial institution and ask for verification. At a larger banking concern, such every bit PenFed, cashier's bank check verification would follow a ready procedure. In that location'due south no charge to verify a cashier's check.

If y'all can't visit in person to trace a cashier's check, independently confirm the telephone number of the bank as listed on the cheque, then call the bank and ask to verify the cheque. All banks require these pieces of information to verify a cashier'south bank check:

- Check number

- Name of the person who gave you the check

- Payment corporeality

How To Greenbacks a Cashier's Cheque

It's best to greenbacks or eolith a cashier's check at the bank that issued information technology, as the validation procedure is easier. Otherwise, you'll need to cash it at some other bank where you take an account. You'll need to nowadays ID verifying that you are the payee the check is made out to, along with your banking concern business relationship number or ATM carte.

CASHING AT A Unlike BANK

Because of the prevalence of fraud involving cashier's checks, a bank that did not issue the check might not allow you to cash or eolith the check. Or, you might exist subject to a longer wait period for the funds to become bachelor. Discuss this issue with the bank prior to the transaction.

If you're wondering whether cashier's checks articulate immediately, be enlightened that there is typically a waiting period. Certain check-cashing businesses, likewise as many Walmart stores, tin can cash a cashier's check for y'all, but they volition likely charge a fee. Walmart, however, promises the cash immediately.

What To Exercise If Y'all're a Victim of Cashier'south Check Fraud

If you lot're a victim of cashier's check fraud, it's essential to report it immediately. Talk to your banking concern about how to resolve the issue. You should also written report it to:

- The Federal Trade Commission

- Your state's attorney general

If the cashier'due south bank check was sent past mail, yous should too study information technology to the United States Postal Inspection Service.

This article has been updated with additional reporting since its original publication.

Source: https://www.gobankingrates.com/banking/checking-account/how-verify-cashiers-check/

0 Response to "How Do You Know if a Cashiers Check Is Fraudulent"

Post a Comment